Mortgage lending capacity

Shop Multiple Lenders And Get Better Pricing. Ad Were Americas Largest Mortgage Lender.

Mortgage Industry Underwriting Process And Ways To Improve It

Divide that cash flow.

. What More Could You Need. Best for overall mortgage experience. As a result mortgage lenders can view accurate data immediately.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Get Your Best Interest Rate for Your Mortgage Loan. NerdWallets Best Mortgage Lenders of September 2022.

The 5 Cs of Mortgage Lending. Compare Quotes Now from Top Lenders. The 5 Cs of Mortgage Lending.

Lock Your Mortgage Rate Today. Save Time Money - Start Now. Become An Independent Mortgage Professional And Experience Faster Turn Times.

The principles of mortgage lending. For your personalized rate quote contact a Mortgage Loan Officer today. The company said loan origination volume in the quarter totaled just under 16 billion down nearly 26 from the first quarter and down nearly 54 from the second quarter.

Different lenders require different. Ad Review the Best Mortgage Loan Software for 2022. Ad Find Todays Mortgage Rates - 2022.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home loan. Shop Multiple Lenders And Get Better Pricing. View your borrowing capacity and estimated home loan repayments.

Standards may differ from lender to lender but there are four core components the four Cs that lender will evaluate in determining whether they will make a loan. Best for digital convenience. Of these 880 loans 43 loans 489 were made to applicants reporting as Black or Hispanic.

See Todays Rate Get The Best Rate In A 90 Day Period. Ad Join The Wholesale Mortgage Industry. Adjustable Rate Mortgage ARM interest rates and payments are subject to increase after.

Mortgage lending 30 focuses on using open banking to input data in real-time. Ad FHA VA Conventional HARP And Jumbo Mortgages Available. Compare Quotes See What You Could Save.

Ad Find Mortgage Lenders Suitable for Your Budget. The 5 Cs of Mortgage Lending. Hunt Mortgage originated 880 residential loans in the Syracuse MSA.

They can also use this data to make. Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. Annual Rental Income Vacancy Loss Payments Expenses Cash Flow.

Job in Buffalo - Erie County - NY New York - USA 14205. Ad Join The Wholesale Mortgage Industry. Lowest Mortgage Refinance Rates.

Community Bank System Inc. A formula for you to use to quickly determine if the property cash flows is. Become An Independent Mortgage Professional And Experience Faster Turn Times.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less. So in a series of blogs I am going to go over one of my first and core lessons on mortgage lending The 3 Cs which are.

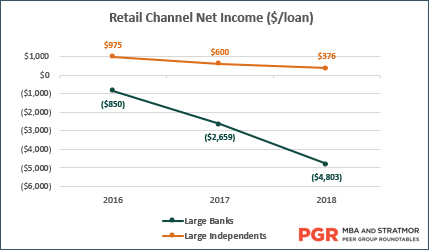

The Large Bank Mortgage Banking Profitability Conundrum Stratmor Group

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

The 5 Cs Of Credit

Ai And Automation In Loan Origination And Underwriting Capacity

/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Tips To Increase Your Borrowing Capacity Your Mortgage

What Is Asset Based Lending Who Qualifies

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

The Future Of The Mortgage Industry Ways Ai Will Impact The Lending Workforce Capacity

What Can Affect Your Borrowing Power

Mortgage Serviceability Test Rates Dropped Afford To Borrow More

Accessing Mortgage Financing Options For Buyers Of Shared Equity Homes Grounded Solutions Network

Lvr Borrowing Capacity Calculator Interest Co Nz

Guide To Your Home And Mortgage In Divorce 2022

Encompass Capacity

How Much Can I Borrow Home Loan Calculator

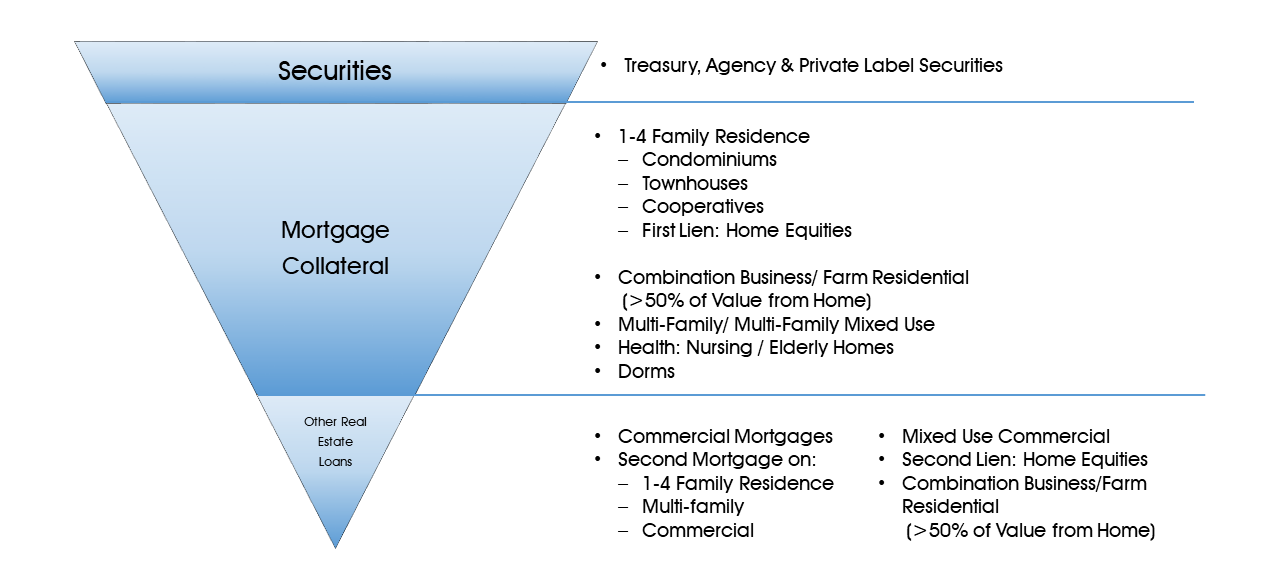

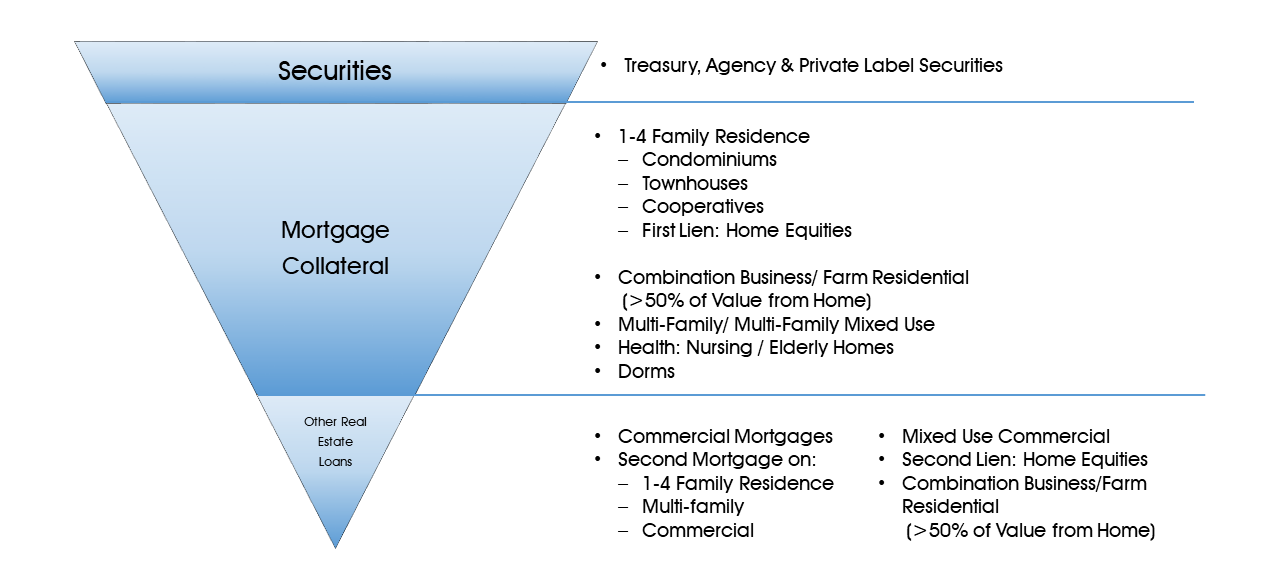

Collateral Guide Federal Home Loan Bank Of New York